Content

The Search Fund Pitch Deck to Secure Investor Buy-in for Your Target Acquisition

Click here to download our Pitch Deck template

Finding a target company is only half the battle.

The real crucible is convincing seasoned investors that this specific business, under your leadership, is the opportunity they’ve been waiting for.

Investors have heard it all, and they’re tired of the fluff.

This guide will help you master each critical component of your acquisition pitch, allowing you to answer the tough questions before investors do.

Let’s build a deck that has a fighting chance.

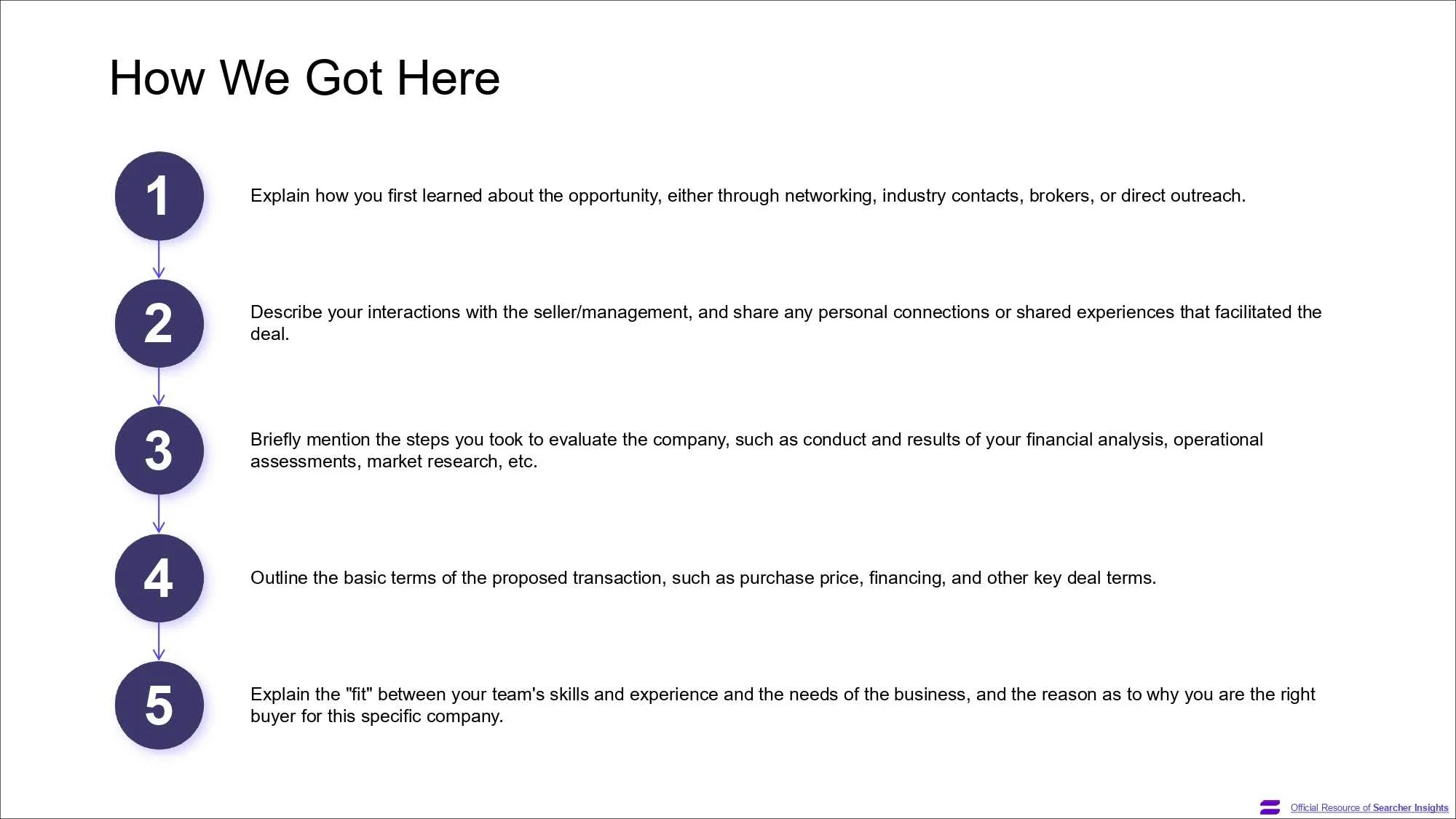

Chapter 1: Investment Thesis

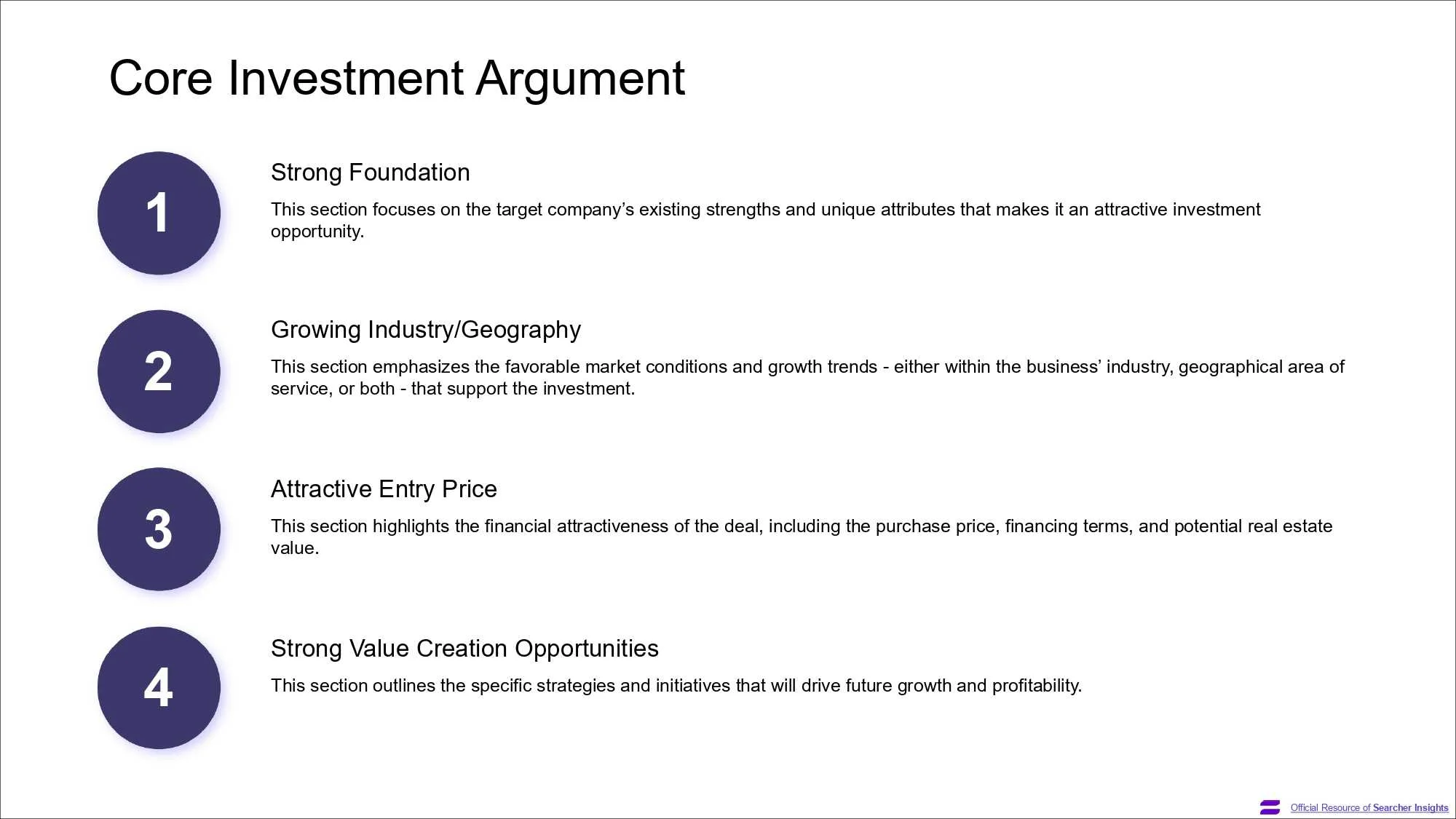

Your Investment Thesis is the cornerstone of your pitch.

It’s where you articulate the core logic behind why this specific acquisition is a compelling opportunity.

Investors need to quickly grasp your strategic vision and the fundamental reasons for your belief in the target company’s potential for success and return on investment. A clear, concise, and well-supported thesis sets the stage for everything that follows.

Our Tips for Crafting Your Investment Thesis

- Clearly Define Your “Why”: Articulate what makes this company an attractive investment right now. Is it a fragmented market ripe for consolidation, a company with untapped operational efficiencies, or a business poised to benefit from strong industry tailwinds?

- Highlight the Strong Foundation: Showcase the target company’s existing strengths, unique attributes, and competitive advantages that make it a solid platform for growth.

- Emphasize Market Opportunity: Detail the favorable market conditions, growth trends within the industry or geography, and how the target is positioned to capitalize on them.

- Justify the Entry Price: Explain why the acquisition price is attractive and how the deal structure makes financial sense for investors.

A compelling investment thesis succinctly answers: Why this company? Why this industry? Why now? And why you? It should demonstrate a deep understanding of the business and the market, laying out a clear path to value creation.

With a strong investment thesis established, the next logical step is to provide a concise overview of the entire opportunity, which leads us to the Executive Summary.

Chapter 2: Executive Summary

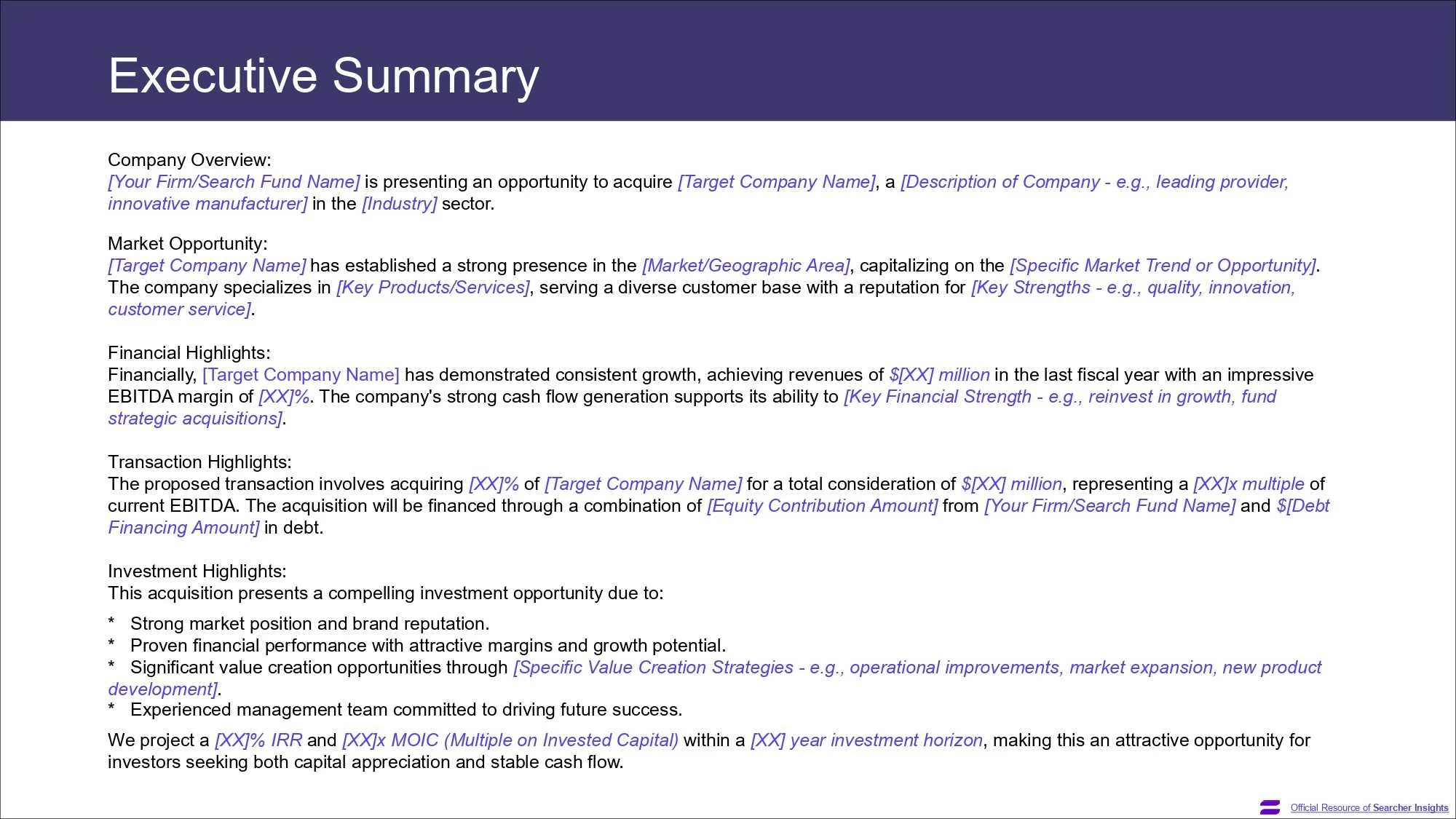

The Executive Summary is your pitch in miniature.

Many investors will decide whether to read further based on these critical first impressions.

It needs to be compelling, comprehensive yet brief, and hit all the key highlights of the investment opportunity, reassuring them that their time reviewing your full deck will be well spent.

Our Tips for Crafting Your Executive Summary

- Company Overview: Clearly state your search fund’s name and introduce the target company, its industry, and its core business

- Market Opportunity Snapshot: Briefly describe the market the target operates in, any specific trends it’s capitalizing on, and its key products/services and strengths.

- Key Financial Highlights: Showcase impressive and consistent financial performance, such as revenue, EBITDA margin, and cash flow generation capabilities.

- Transaction Highlights: Summarize the proposed acquisition terms, including the percentage being acquired, total consideration, EBITDA multiple, and how the deal will be financed (equity and debt breakdown).

- Investment Merits & Projected Returns: Concisely list the top reasons why this is a strong investment (e.g., market position, financial performance, value creation opportunities, experienced management) and state your projected IRR and MOIC within a defined investment horizon.

The Executive Summary should give investors a complete, albeit high-level, understanding of the target company, the market opportunity, the deal structure, and the potential returns, compelling them to learn more.

After presenting the “what” and “why” in the Executive Summary, investors will want to understand the “how” – specifically, how you identified and validated this opportunity. This naturally transitions into an overview of the industry.

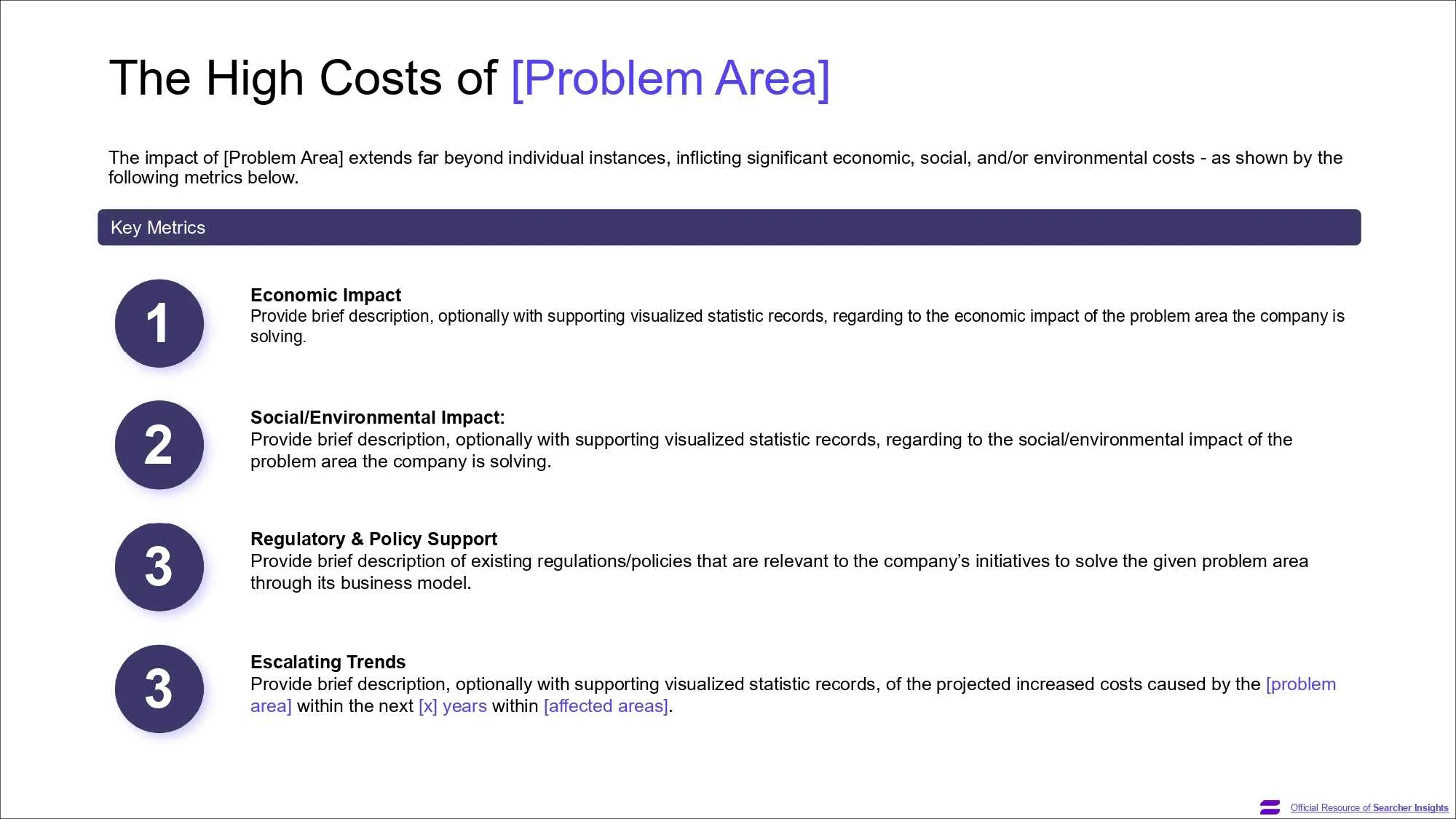

Chapter 3: Industry Overview

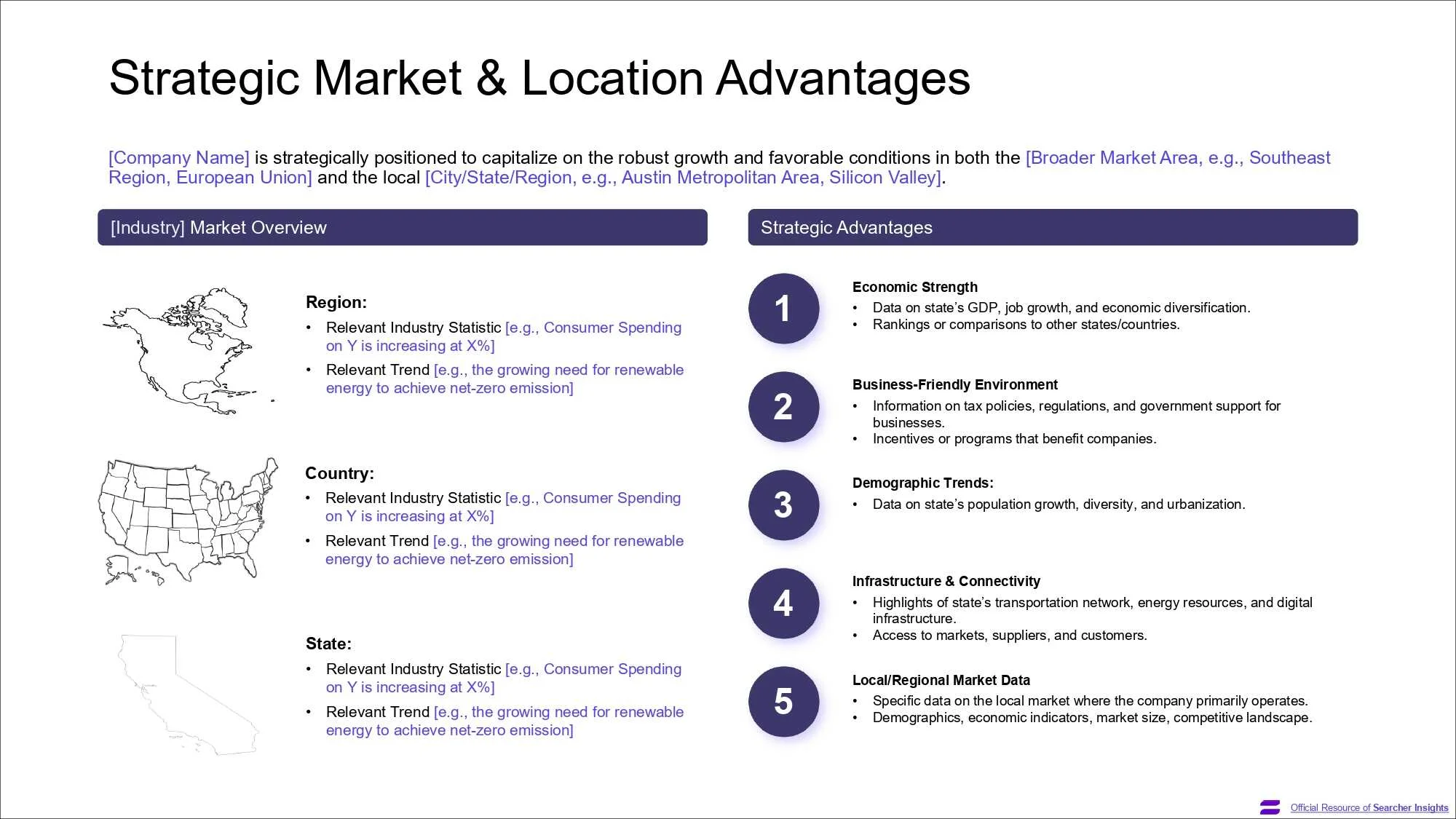

Investors need to be convinced that the target company operates in an attractive and supportive industry.

An industry overview demonstrates your understanding of the broader market dynamics, including its size, growth trends, competitive forces, and any tailwinds that will benefit the target.

It provides context for the company’s current performance and future potential.

Our Tips for Crafting an Impactful Industry Overview

- Quantify Market Size and Growth: Provide data on the current market value and projected growth rates, ideally showing that it’s outpacing the general economy.

- Identify Favorable Trends: Discuss key macro and microeconomic trends supporting industry expansion, such as demographic shifts, technological advancements, increasing social acceptance, or regulatory support.

- Analyze Market Fragmentation (if applicable): If the industry is fragmented, highlight this as an opportunity for consolidation and growth, positioning your acquisition as a platform for future roll-ups.

- Pinpoint Strategic Location Advantages: If relevant, discuss how the company’s geographic location offers specific benefits related to economic strength, a business-friendly environment, infrastructure, or access to local market dynamics.

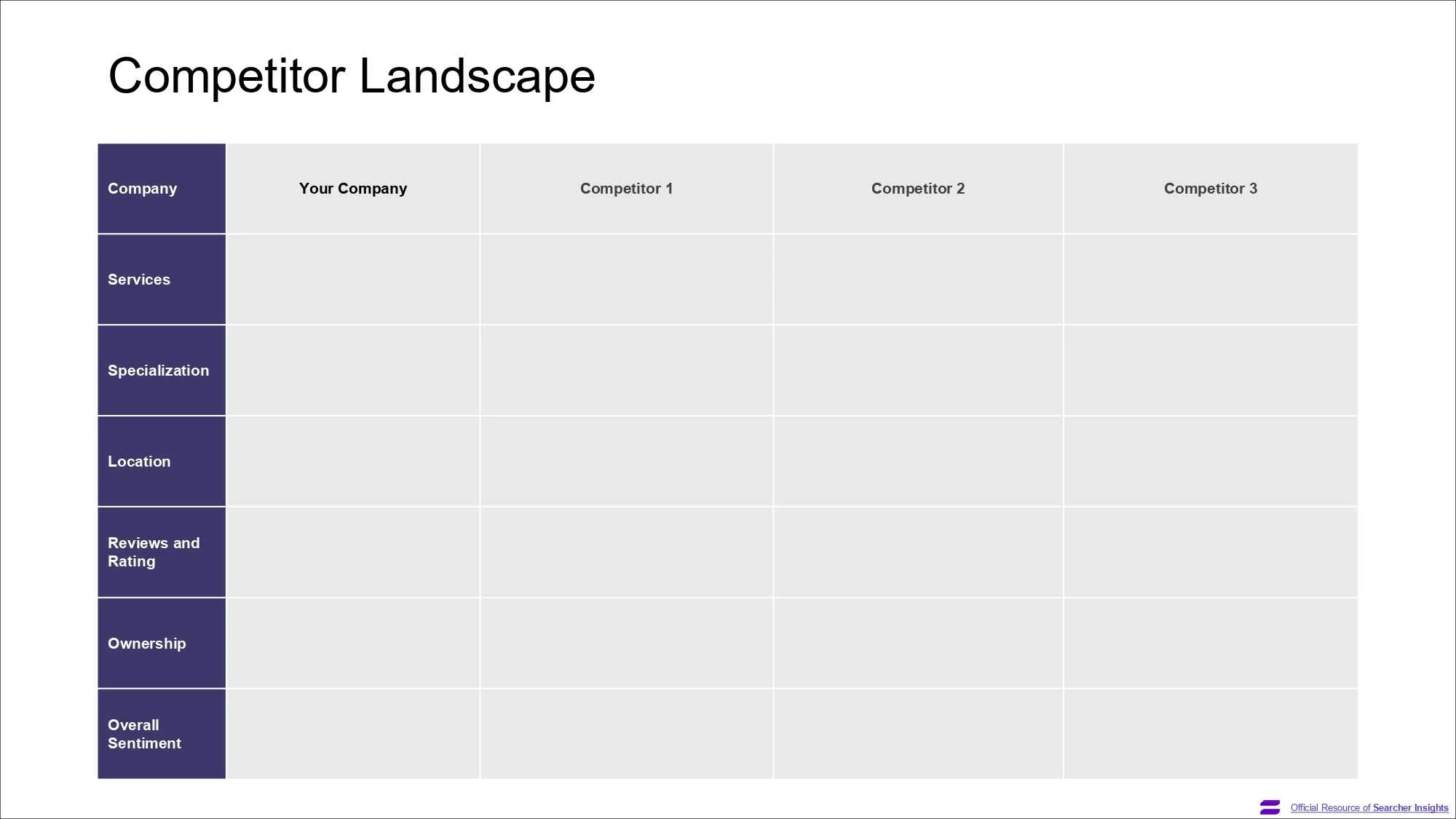

- Assess the Competitive Landscape: Briefly map out the key competitors, providing context for your target company’s position within the industry.

A strong Industry Overview paints a picture of a thriving or promising market where a well-positioned company can achieve significant growth and profitability, supported by tangible data and clear trends.

Having established the attractiveness of the industry, the focus naturally shifts to the specific player you’re proposing to acquire – the Target Company.

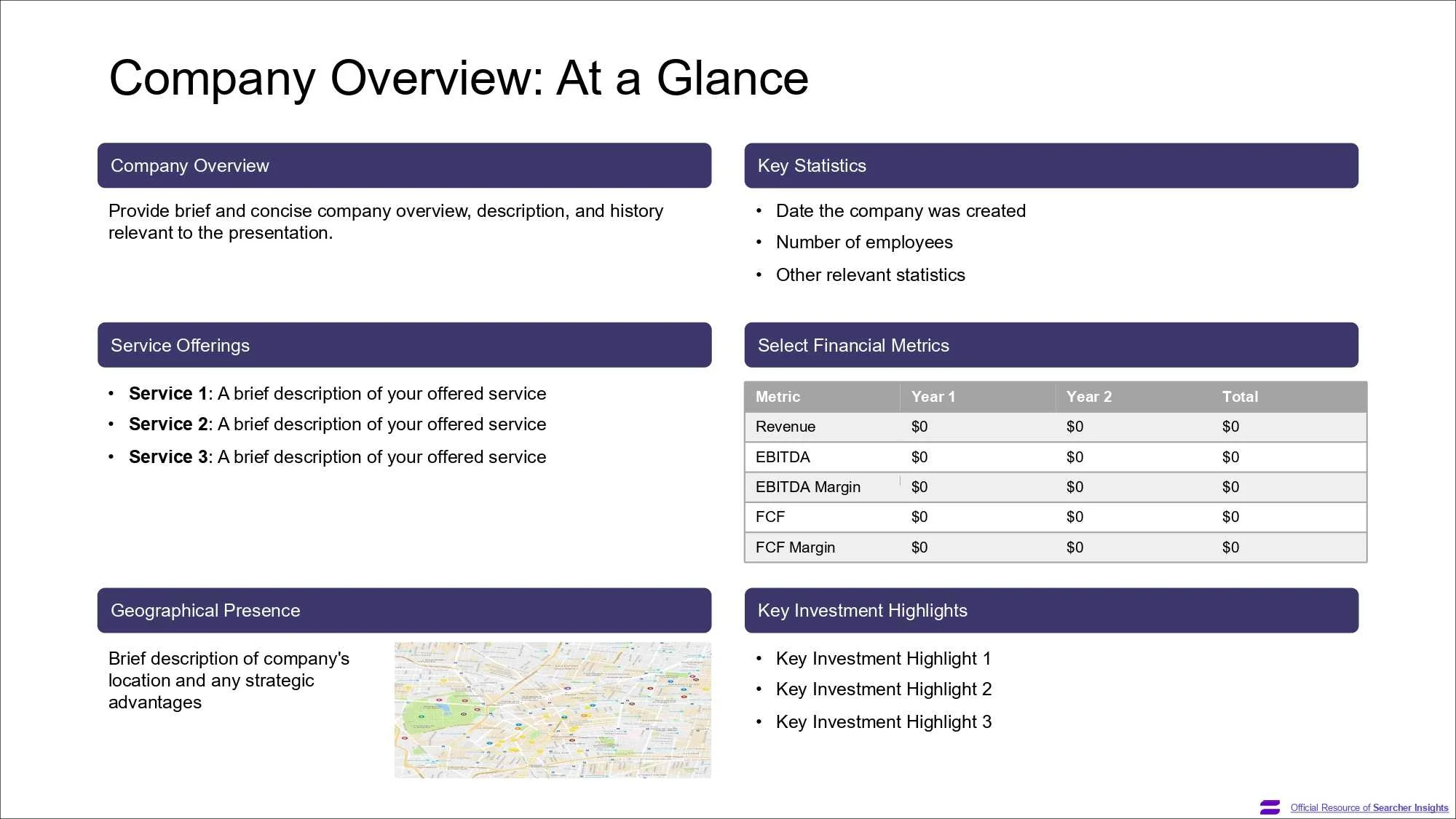

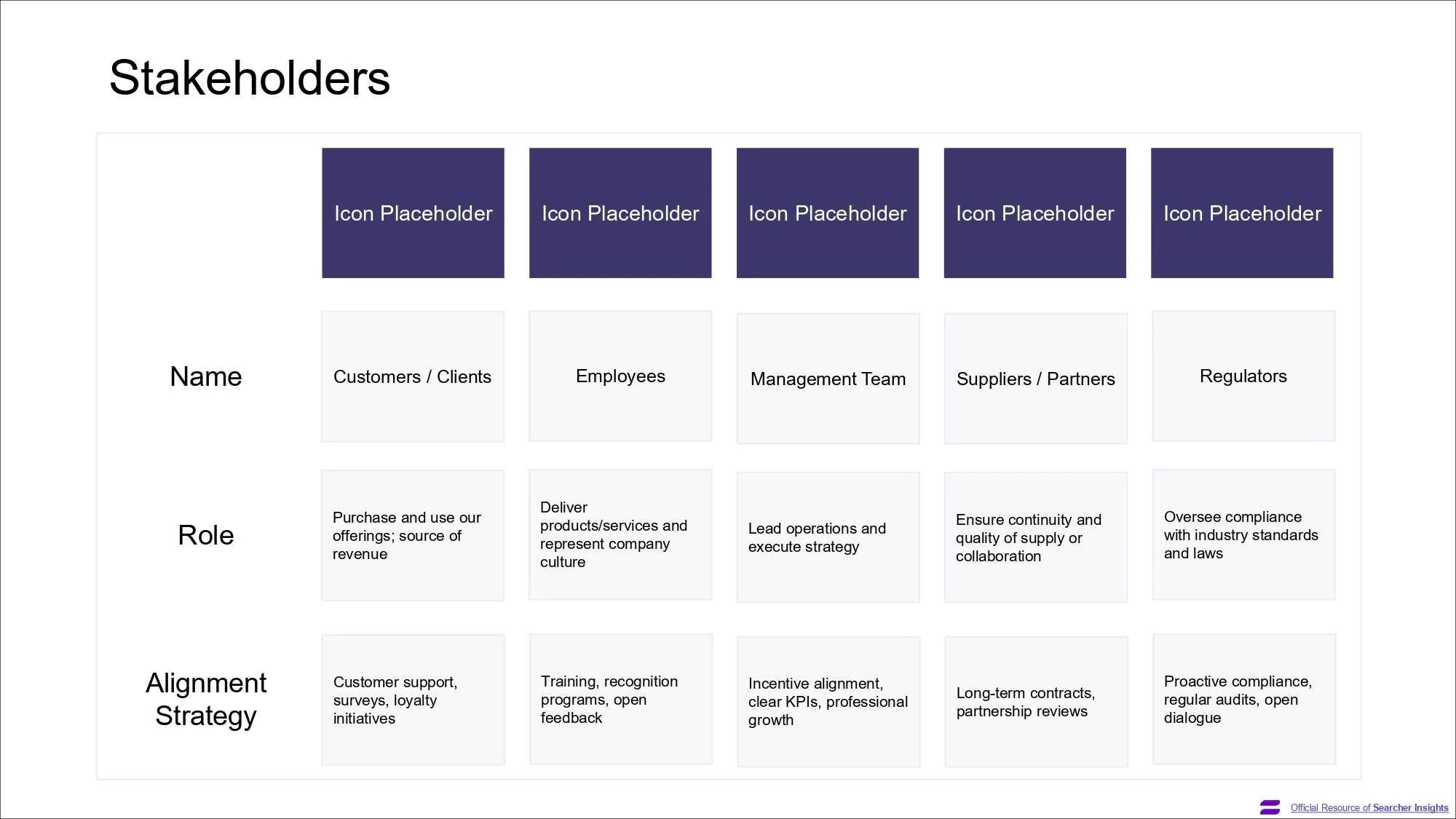

Chapter 4: Target Company Profile

This chapter is where you bring the target company to life.

Investors need a deep understanding of its history, what it does, how it operates, its financial health, and the team behind it.

This section builds confidence that the company is a solid, well-managed entity with a clear value proposition.

Our Tips for Crafting your Target Company Profile

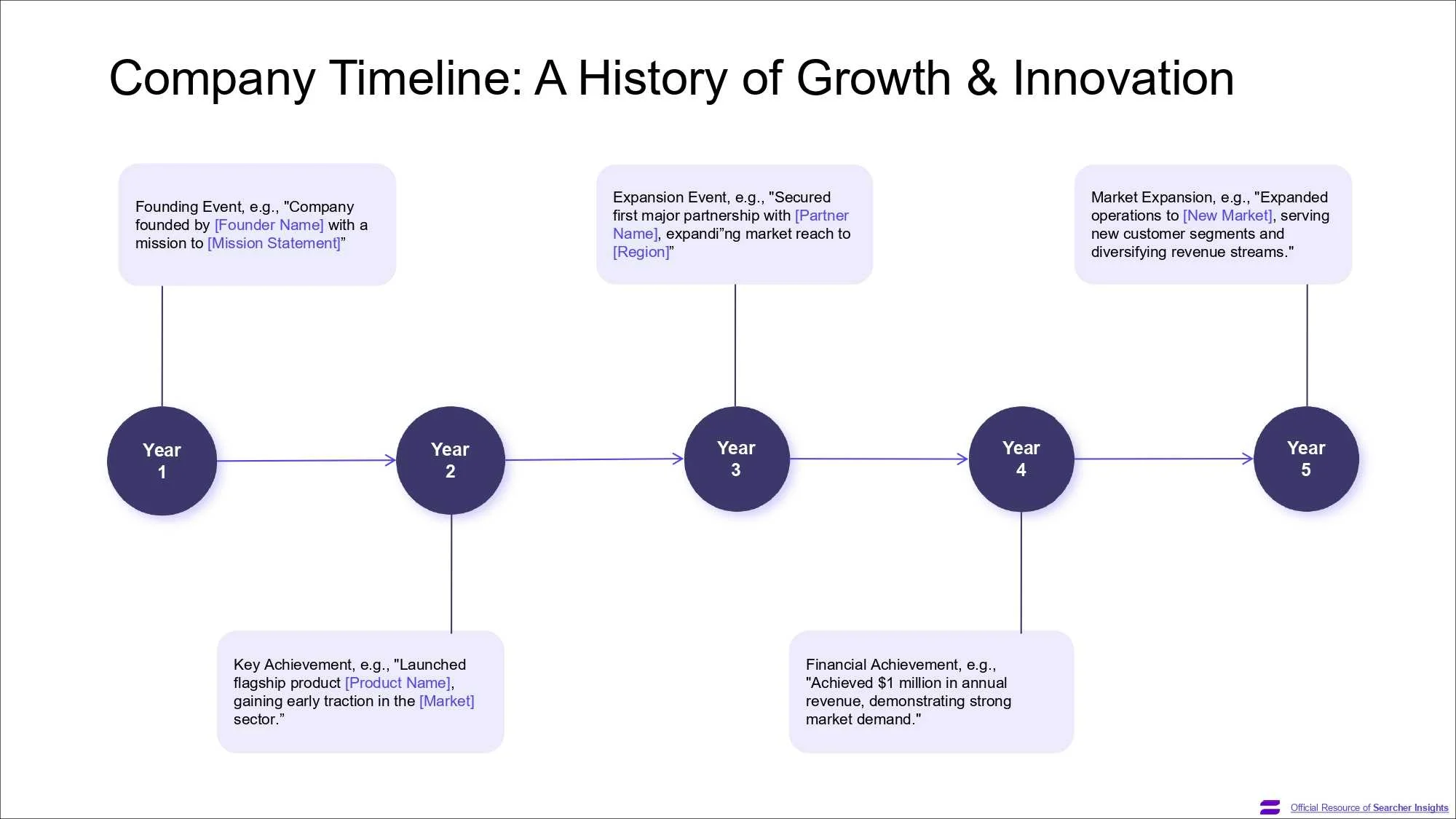

- Company “At a Glance”: Provide a concise overview including its history, key statistics (founding date, number of employees), service offerings, geographical presence, and select financial metrics.

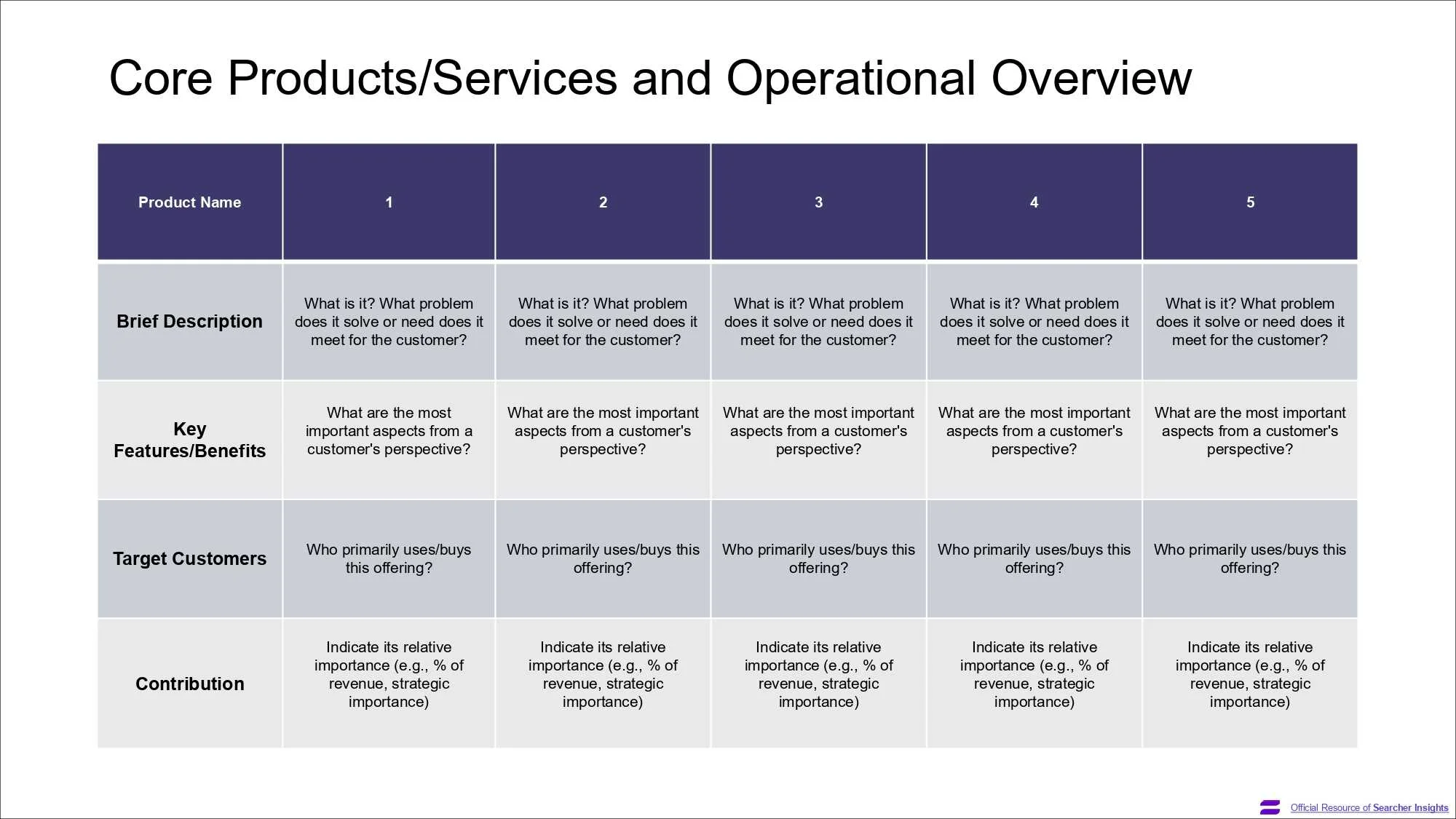

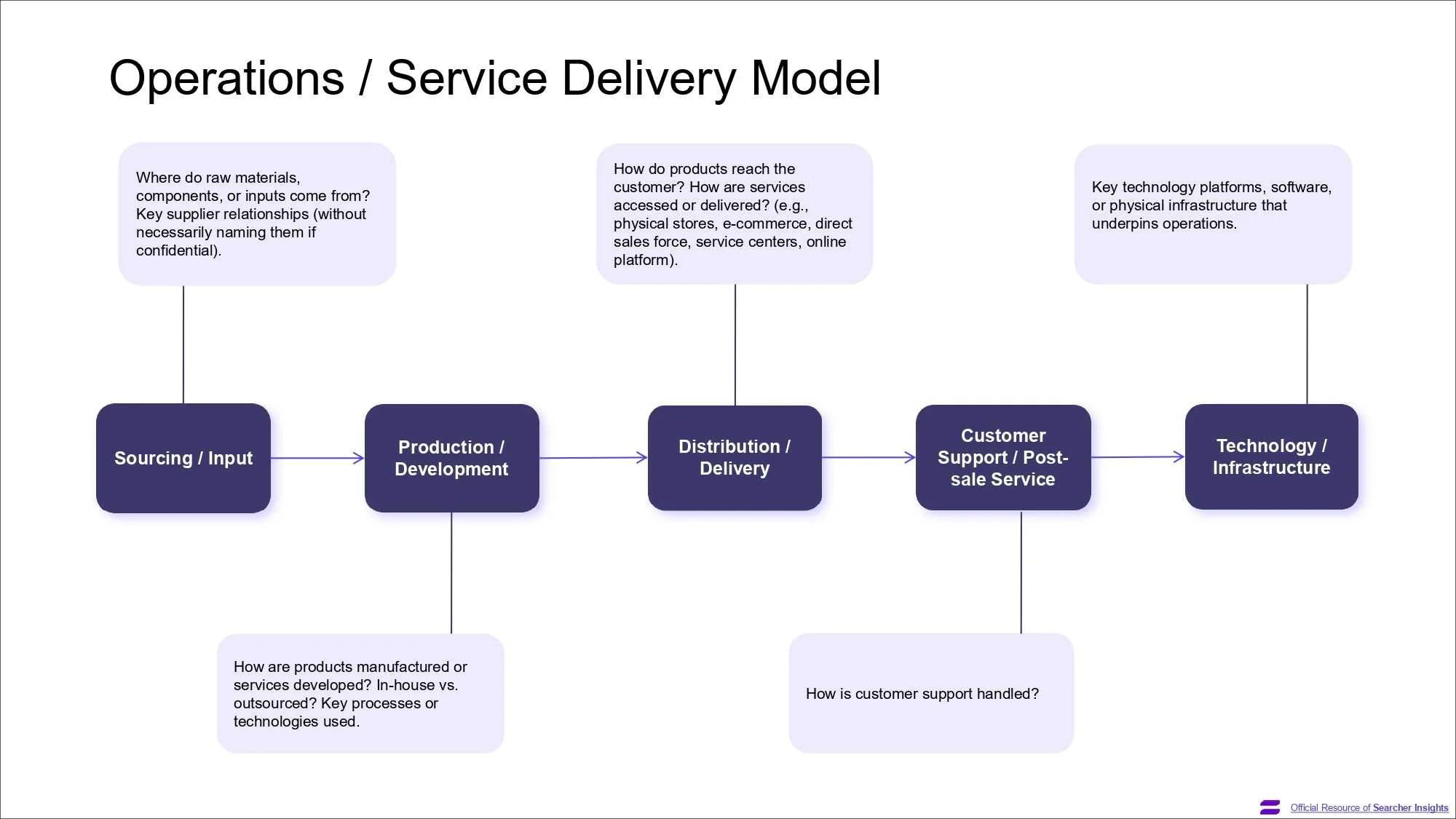

- Detail Core Products/Services & Operations: Describe what the company sells, the problems it solves for customers, its key features/benefits, target customers, and the relative importance of each offering. Outline the operational model from sourcing inputs to customer support and technology infrastructure.

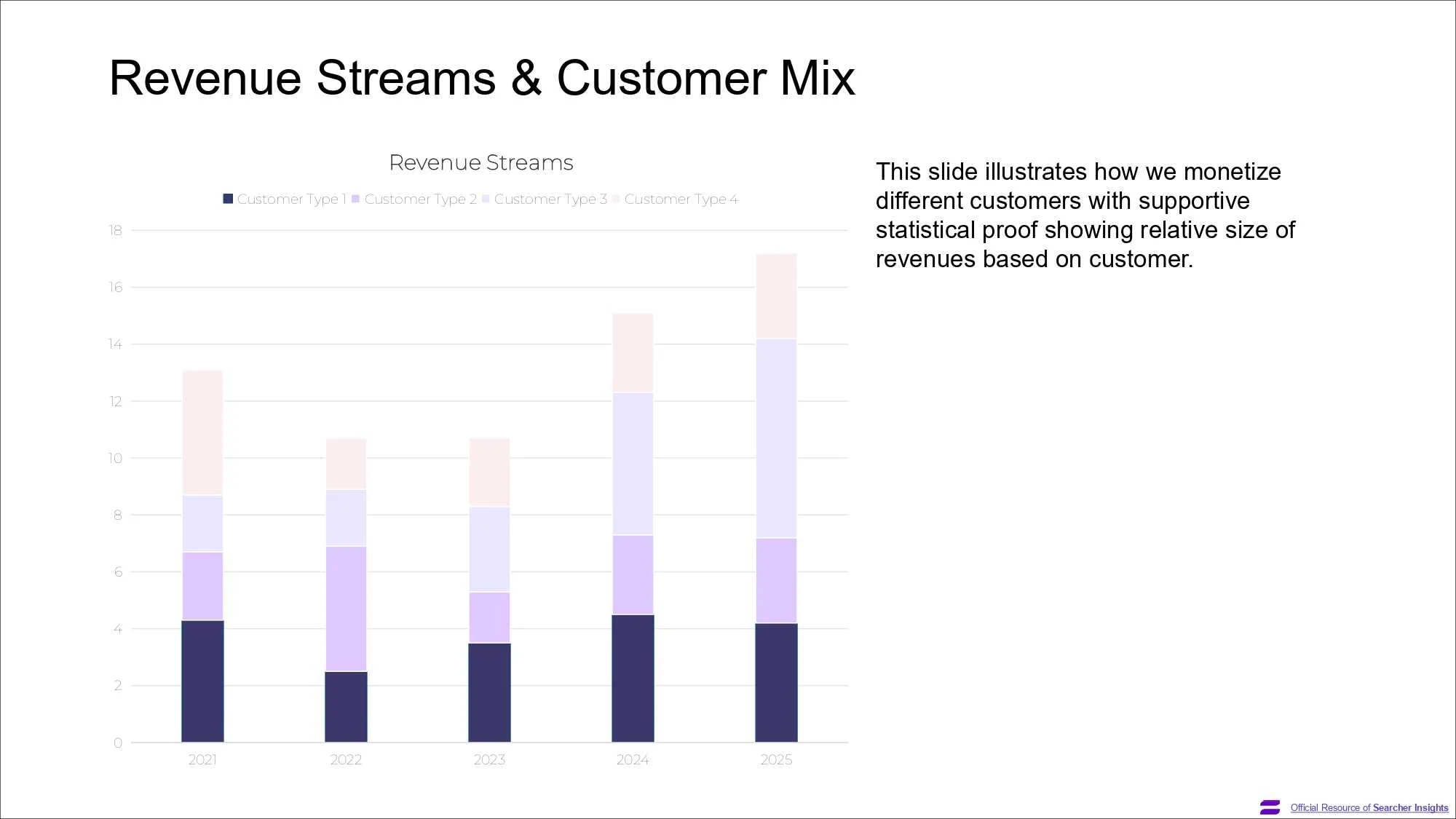

- Illustrate Revenue Streams & Customer Mix: Show how the company monetizes different customer types and the relative size of revenues from each segment, ideally with historical data.

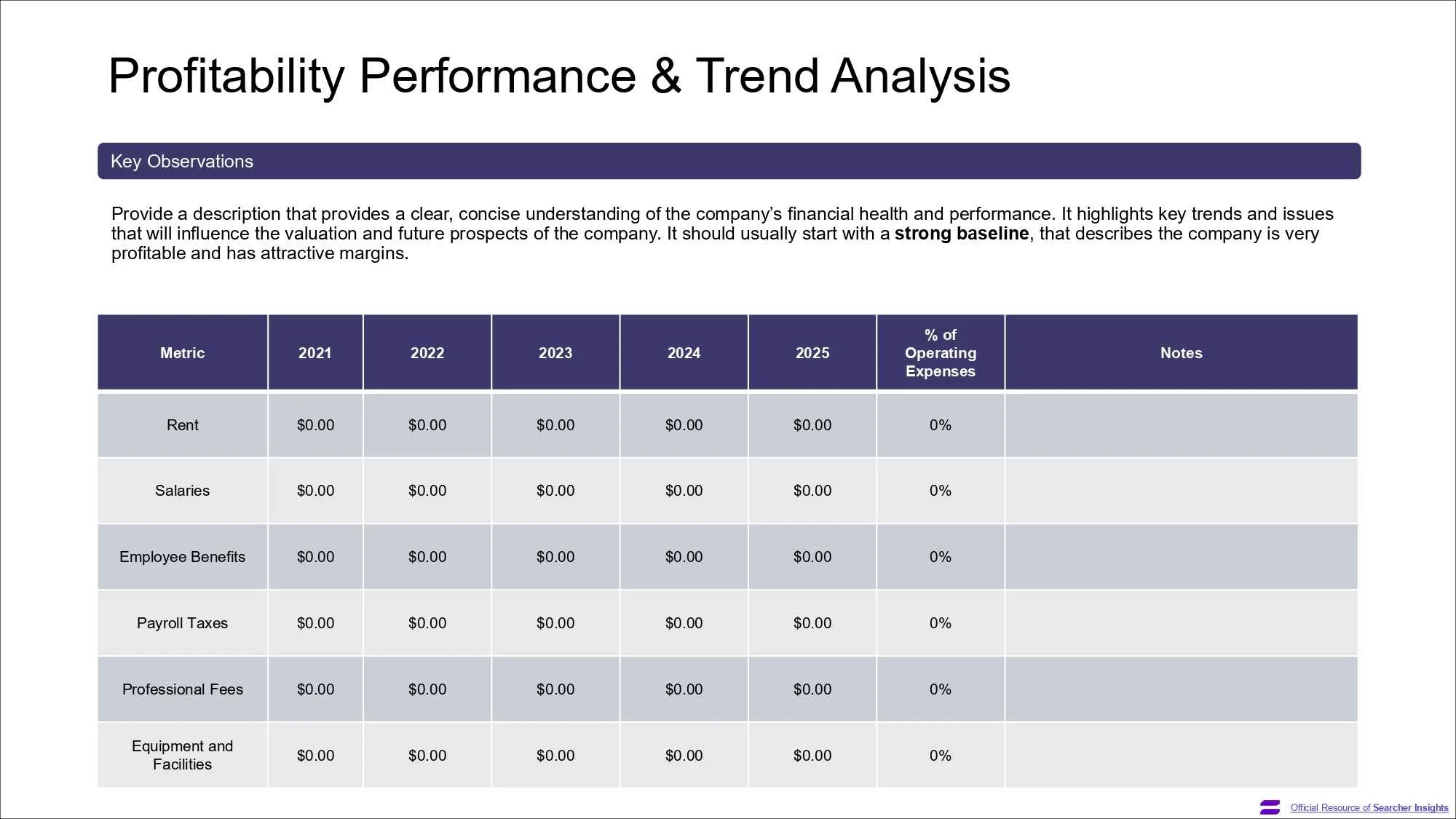

- Analyze Profitability & Trends: Discuss the company’s financial health and performance, highlighting key trends in operating expenses and profitability.

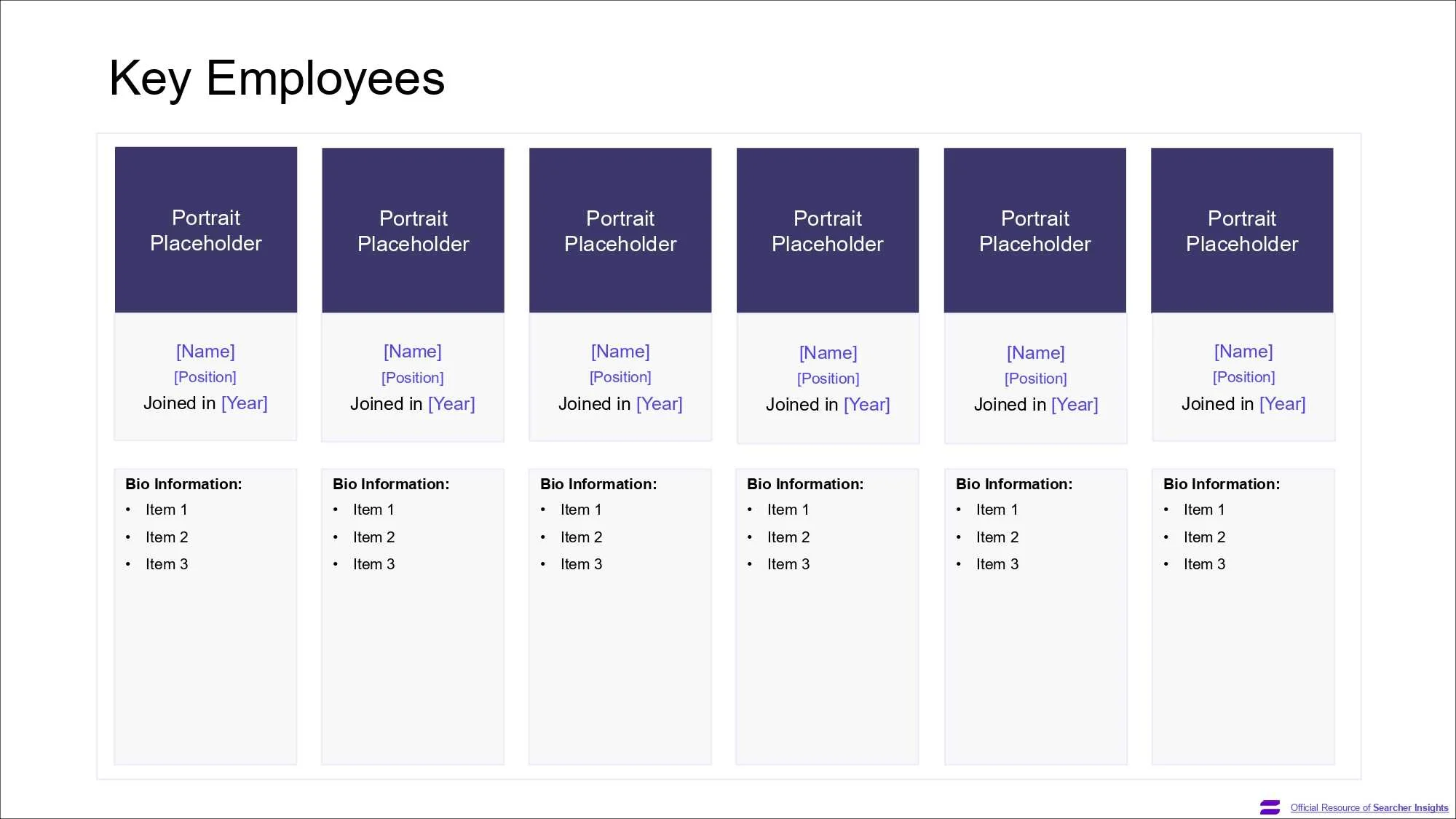

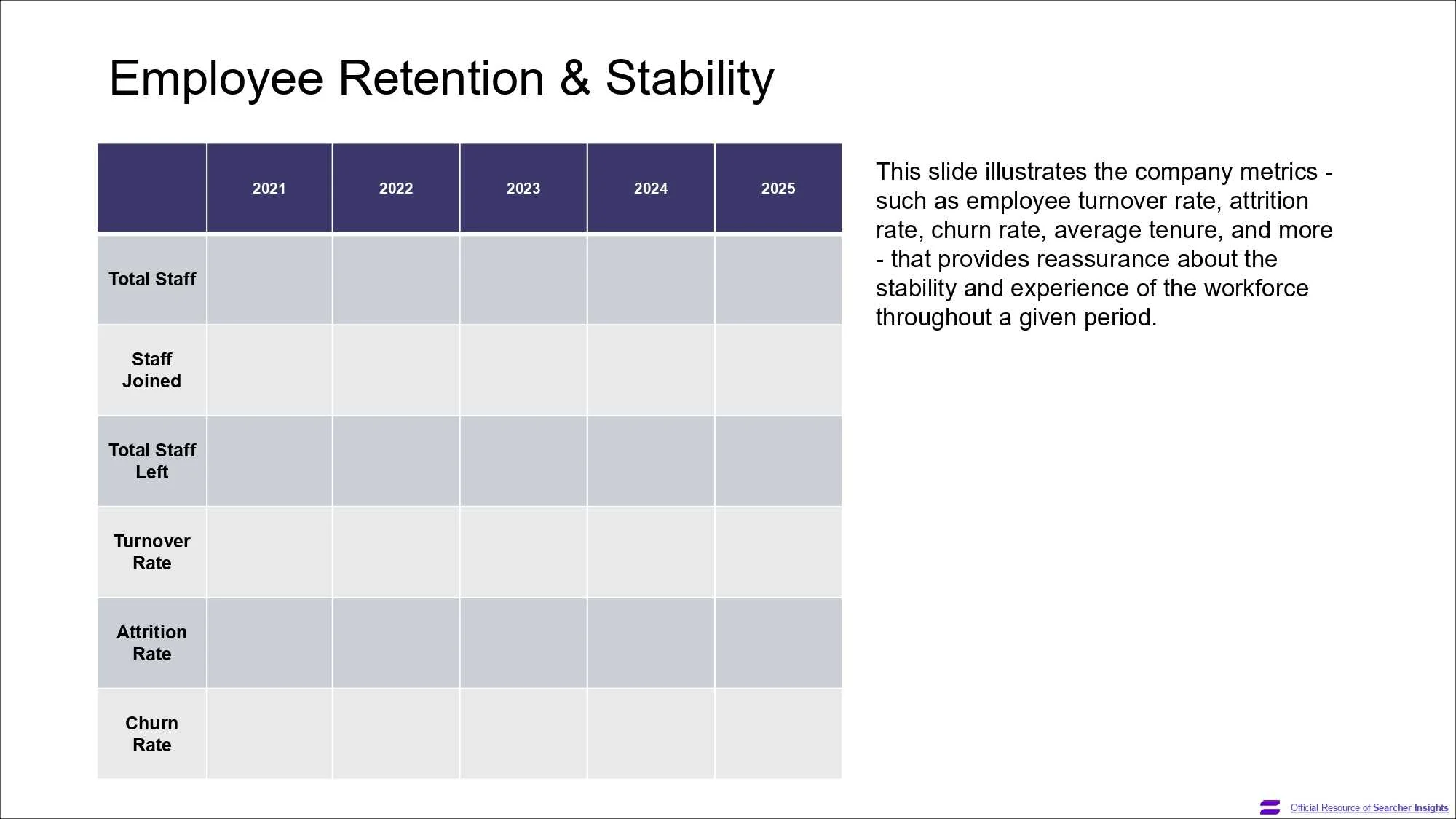

- Introduce Key Employees & Stability: Showcase the core team members (beyond just the owner if applicable), their roles, experience, and provide metrics on employee retention and stability to reassure investors about the workforce.

This chapter should leave investors with a clear and positive impression of the target company as a well-defined business with solid operations, a diversified revenue base, good financial health, and a stable team.

Understanding the company is crucial, but investors also need to know what makes it stand out. This leads directly to defining its unique Value Proposition and Differentiation.

Chapter 5: Value Proposition and Differentiation

In a competitive market, simply being a good company isn’t enough.

Investors need to understand what makes the target company special and why customers choose it over alternatives.

This section is about articulating the company’s unique selling points and the sustainable competitive advantages (its “moat”) that protect its market share and profitability.

Our Tips for Showcasing Value Proposition & Differentiation

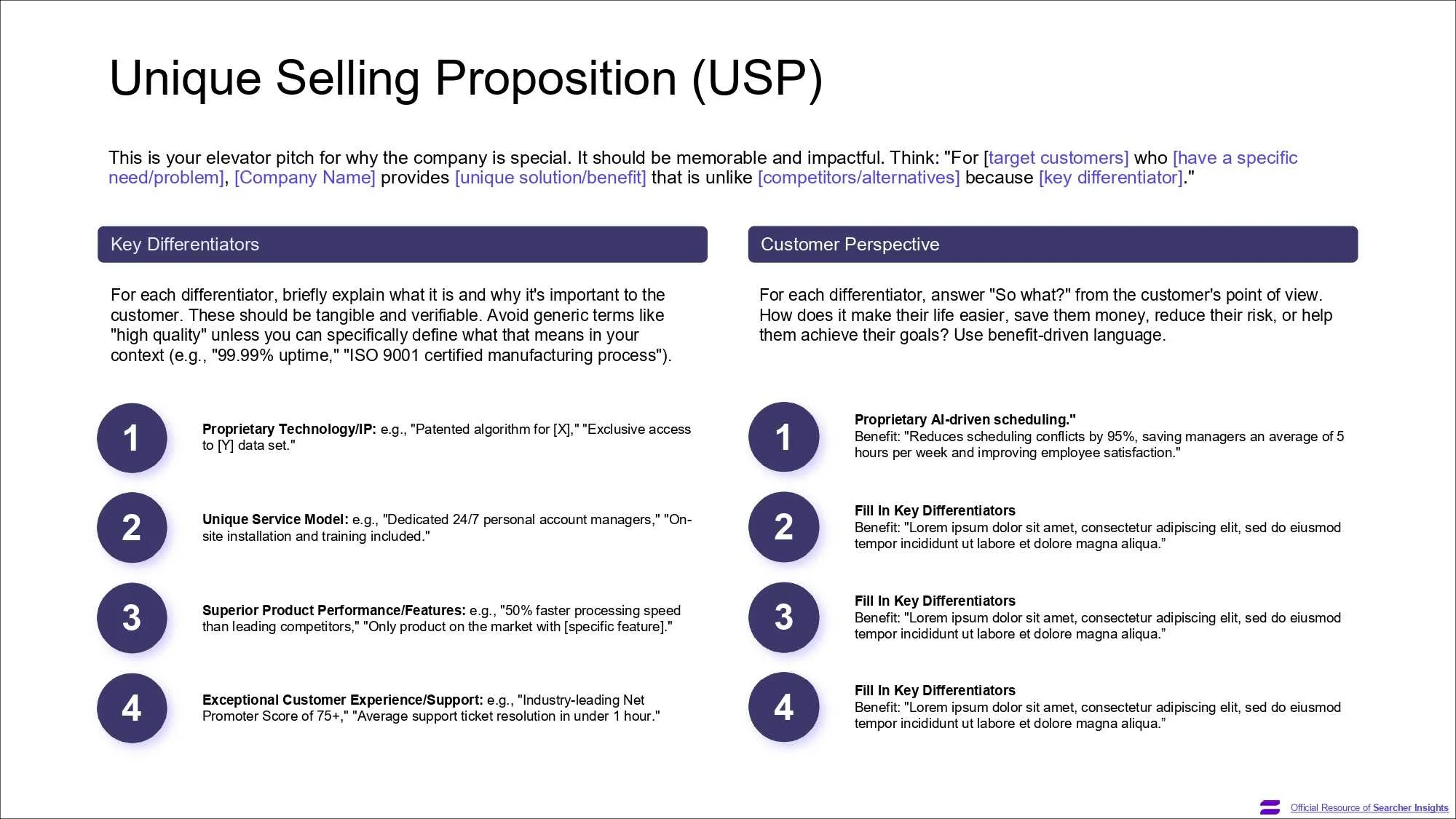

- Craft a Clear Unique Selling Proposition (USP): Develop a concise and impactful “elevator pitch” that explains who the target customers are, the specific need/problem the company solves, and what makes its solution uniquely better than competitors.

- Identify Key Differentiators: List tangible and verifiable differentiators (e.g., proprietary technology, unique service model, superior product features, exceptional customer experience). For each, explain what it is and why it’s important to the customer.

- Focus on Customer Perspective/Benefits: For each differentiator, clearly answer “So what?” from the customer’s viewpoint. How does it make their life easier, save them money, reduce risk, or help them achieve their goals?

- Detail Competitive Advantages (The Moat): Go beyond features to explain the underlying structural strengths that give the company a long-term edge and make it difficult for competitors to replicate (e.g., proprietary IP, high switching costs, strong brand, unique distribution channels).

This section should convince investors that the target company not only offers significant value to its customers but also possesses enduring advantages that will allow it to thrive and defend its position in the market.

Having articulated the company’s unique strengths, it’s powerful to reinforce these claims with external validation. This smoothly transitions to sharing Having articulated the company’s unique strengths, it’s powerful to reinforce these claims with external validation. This smoothly transitions to sharing Expert Takeaways and Market Validation.

Chapter 6: Expert Takeaways and Market Validation

While your analysis is crucial, third-party validation adds significant credibility to your investment thesis.

Sharing insights from industry experts, results from due diligence conversations, or positive customer feedback can powerfully reinforce the attractiveness of the opportunity and mitigate perceived risks.

Our Tips for Presenting Expert Takeaways and Market Validation

- Showcase Due Diligence Insights: If you’ve had conversations with industry experts or platforms that monitor the target company or its peers, share key positive takeaways. For example, how does the target’s performance compare? What specific practices contribute to its success?

- Highlight Opportunities Identified by Experts: If experts see further potential (e.g., underutilized services with strong growth prospects), present this as an upside.

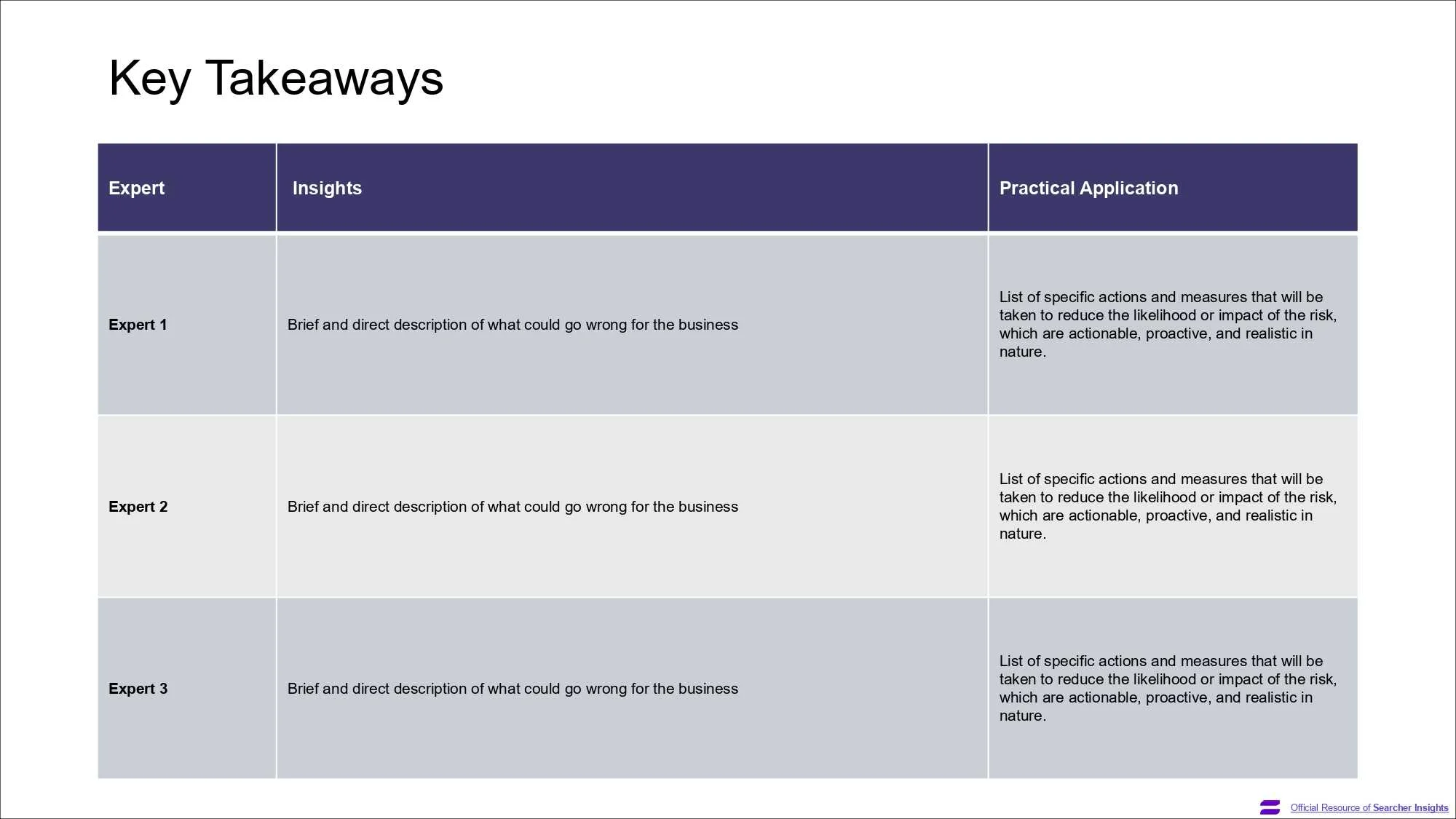

- Structure Key Takeaways Clearly: Summarize insights from different experts or sources in a clear table format, outlining the insight and its practical application or implication for the investment.

- Focus on Actionable Information: Ensure the expert takeaways are not just general praise but provide specific, actionable insights that either support your existing value creation plan or suggest new avenues for growth.

This section should provide investors with added confidence that your assessment of the company and its market is well-founded and supported by knowledgeable third parties, reducing their perception of risk.

With the company’s strengths and market validation established, investors will be keen to understand your specific plans for the future. This leads directly into the Value Creation Plan.

Chapter 7: Value Creation Plan

Acquiring a company is just the beginning; investors are backing your ability to grow it and generate returns.

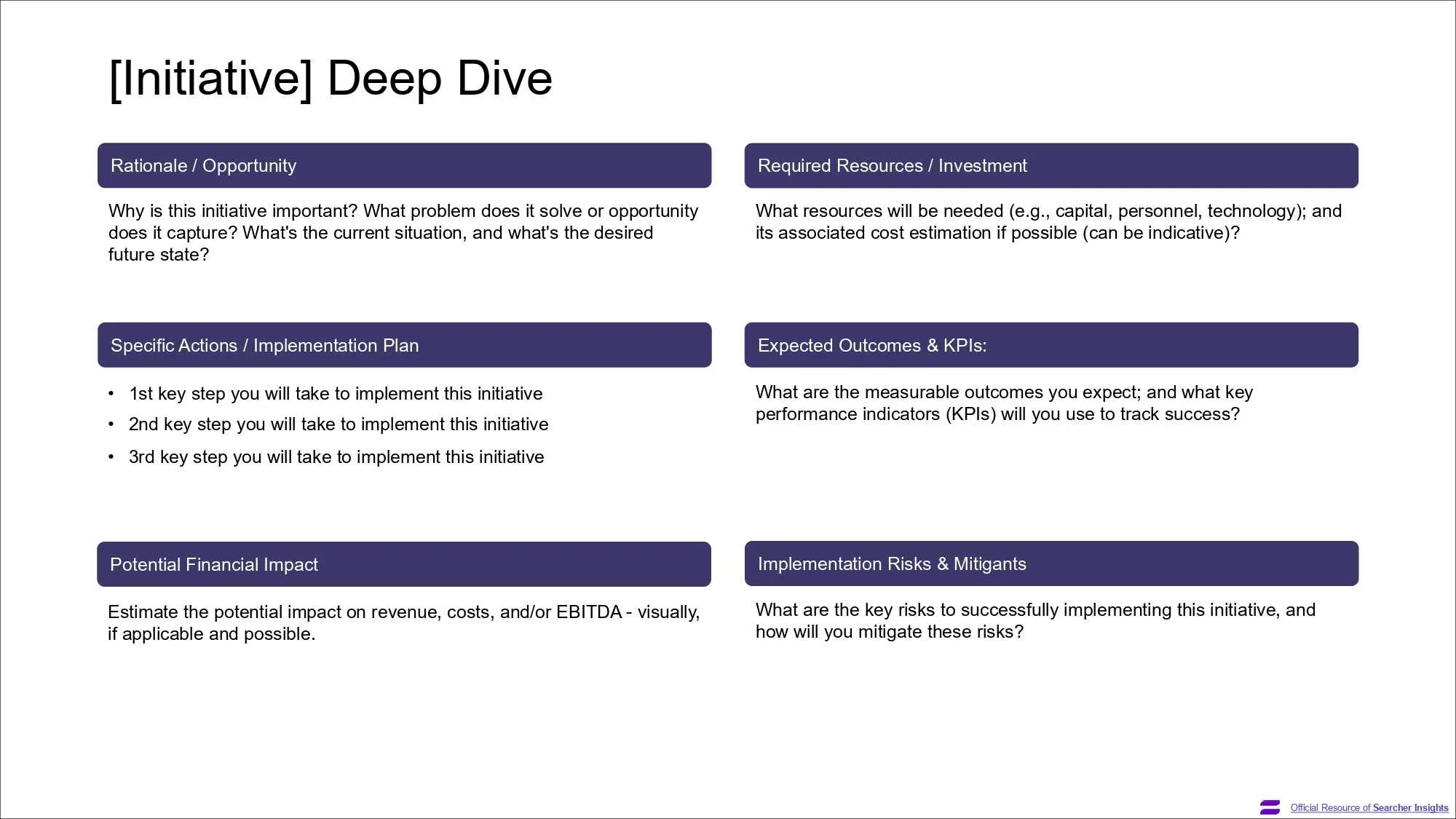

The Value Creation Plan details the specific strategies and initiatives you will implement post-acquisition to drive operational improvements, accelerate sales, innovate, and ultimately increase the company’s value.

This is where you demonstrate your operational acumen and forward-thinking vision.

Our Tips for Presenting Expert Takeaways and Market Validation

- Showcase Due Diligence Insights: If you’ve had conversations with industry experts or platforms that monitor the target company or its peers, share key positive takeaways. For example, how does the target’s performance compare? What specific practices contribute to its success?

- Highlight Opportunities Identified by Experts: If experts see further potential (e.g., underutilized services with strong growth prospects), present this as an upside.

- Structure Key Takeaways Clearly: Summarize insights from different experts or sources in a clear table format, outlining the insight and its practical application or implication for the investment.

- Focus on Actionable Information: Ensure the expert takeaways are not just general praise but provide specific, actionable insights that either support your existing value creation plan or suggest new avenues for growth.

This section should provide investors with added confidence that your assessment of the company and its market is well-founded and supported by knowledgeable third parties, reducing their perception of risk.

With the company’s strengths and market validation established, investors will be keen to understand your specific plans for the future. This leads directly into the Value Creation Plan.

Chapter 8: Transaction Overview

This section details the mechanics of the proposed acquisition.

Investors need to clearly understand the deal structure, sources and uses of funds, and their specific role in the transaction.

Transparency and clarity here are key to building trust and ensuring everyone is on the same page regarding the financial and legal aspects of the investment.

Our Tips for a Clear Transaction Overview

- Summarize Key Terms: Reiterate the purchase price, form of consideration (cash, stock, seller note), and the percentage of the company being acquired.

- Detail Sources and Uses of Funds: Clearly outline where all the capital is coming from (e.g., searcher equity, investor equity, senior debt, seller financing) and how it will be deployed (e.g., purchase of equity, transaction fees, working capital).

- Explain Proposed Capital Structure: Show the post-acquisition capitalization of the company, including all tranches of debt and equity.

- Outline Investor Terms (if applicable at this stage): If specific terms for the current round of investment are being proposed, they would be detailed here (though often this is a subsequent conversation).

- Mention Key Conditions or Closing Items: If there are any critical conditions precedent to closing, briefly mention them.

The Transaction Overview should provide a clear, concise summary of the deal itself, ensuring investors understand the structure, financing, and key terms of the proposed acquisition.

With the deal structure laid out, the final crucial piece is a detailed look at the numbers – the company’s past financial performance and, more importantly, its projected future.

This brings us to Financial Analysis.

Chapter 9: Financial Analysis

The numbers tell a critical story.

This section provides the financial underpinning for your investment thesis and value creation plan. Investors will scrutinize your historical analysis for stability and profitability, and your projections for growth potential and realism.

A thorough and well-reasoned financial analysis is essential to justify the valuation and expected returns.

Our Tips for a Credible Financial Analysis

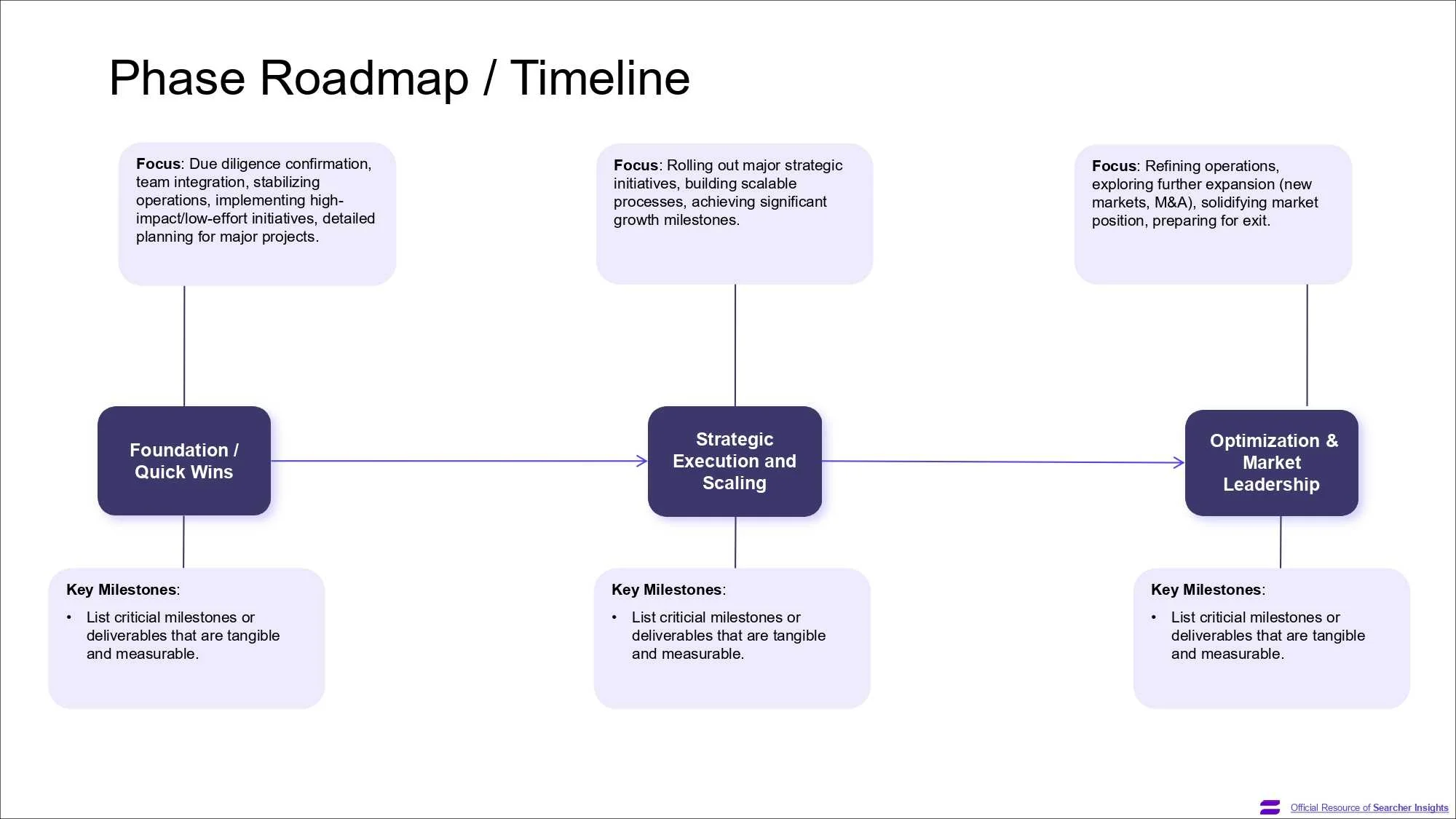

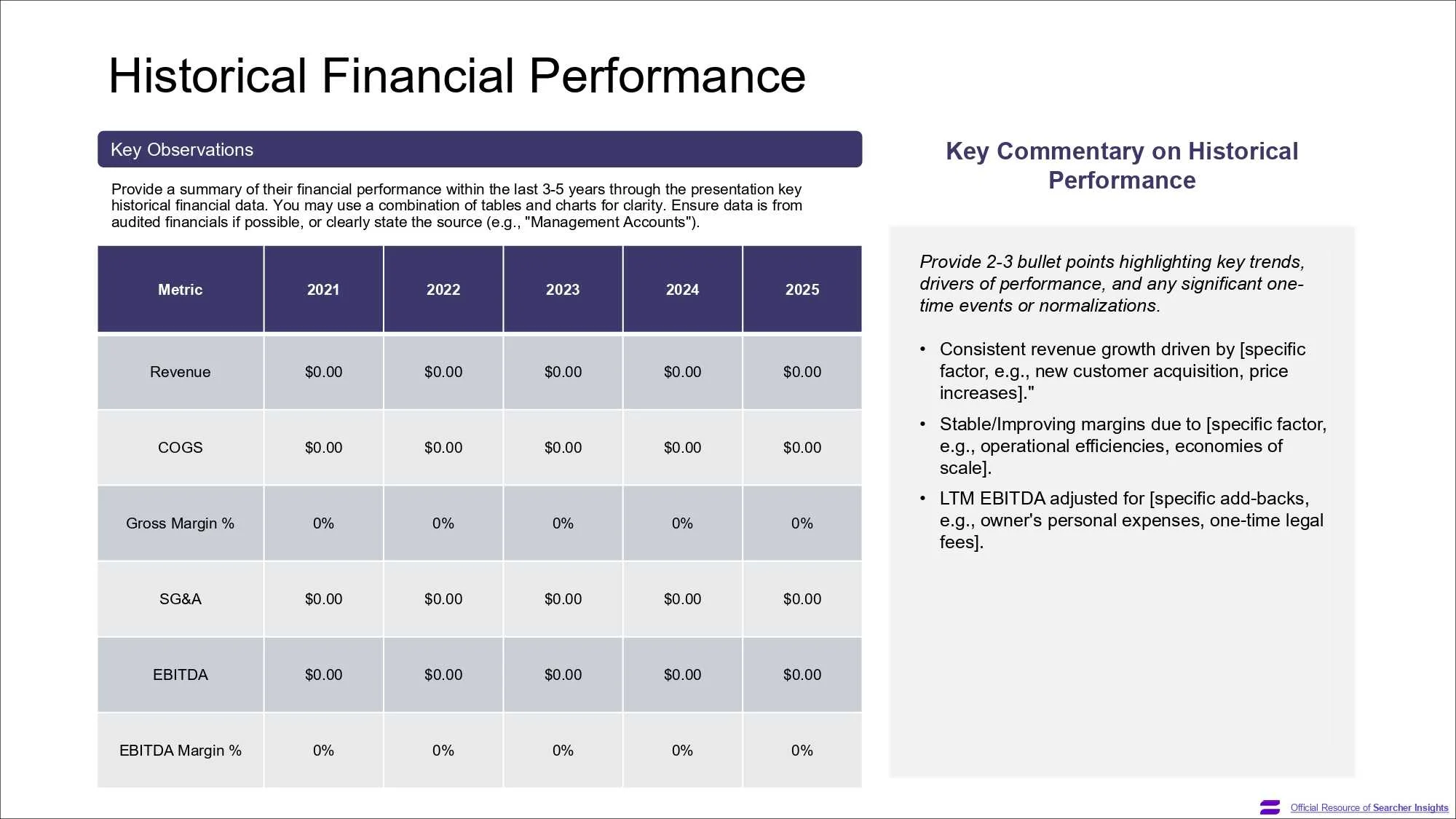

- Present Historical Financial Performance: Show a summary P&L for the last 3-5 years, focusing on key metrics like revenue, COGS, gross margin, SG&A, EBITDA, and EBITDA margin. Include key commentary on trends, drivers, and any normalizations.

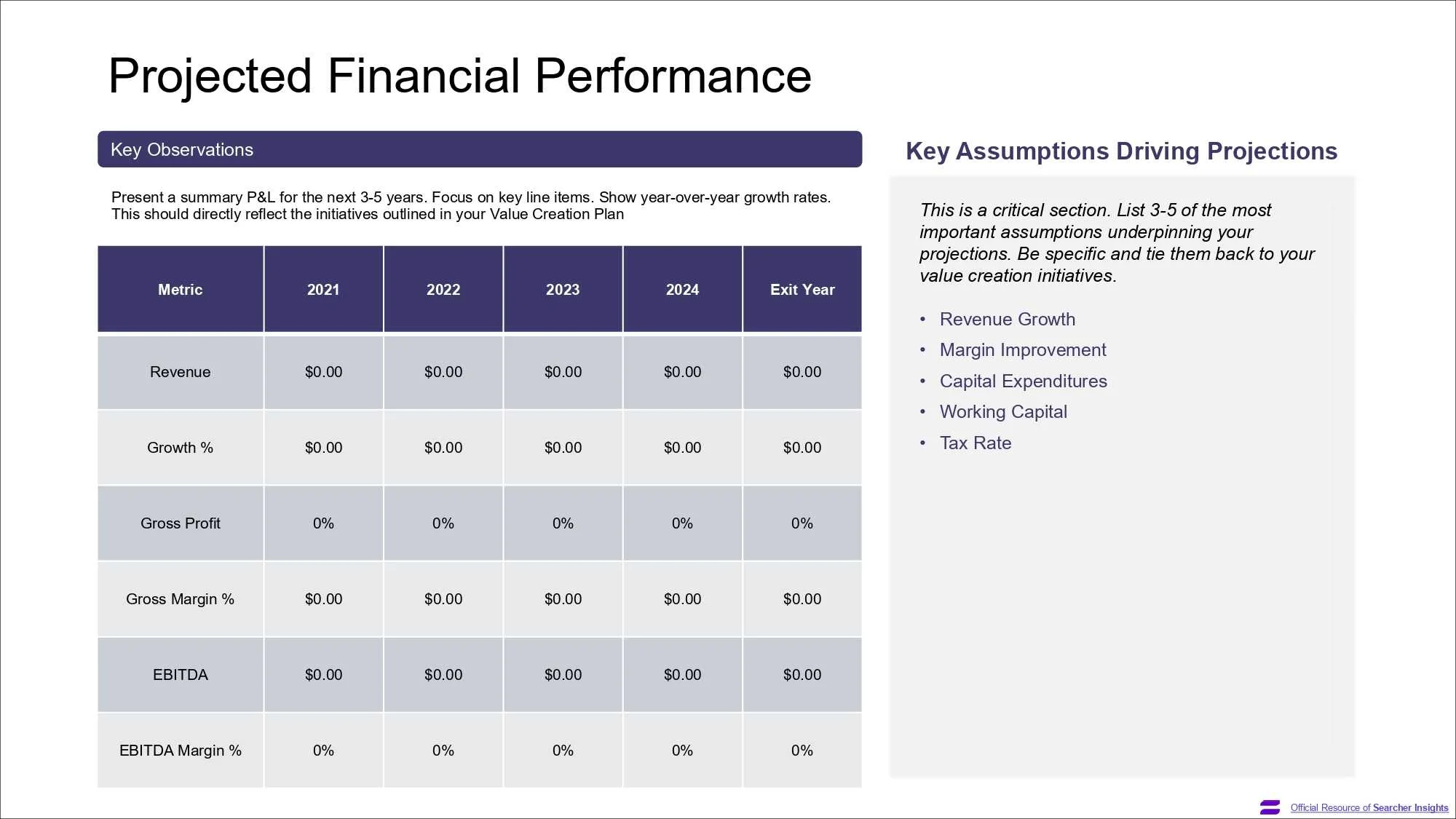

- Detail Projected Financial Performance: Provide a summary P&L for the next 3-5 years (including an exit year), showing year-over-year growth rates and key margins. This should directly reflect the initiatives outlined in your Value Creation Plan.

- Clearly State Key Assumptions Driving Projections: This is critical. List the 3-5 most important assumptions underpinning your projections (e.g., revenue growth rates, margin improvements, capital expenditures, working capital needs, tax rate) and tie them back to your value creation initiatives.

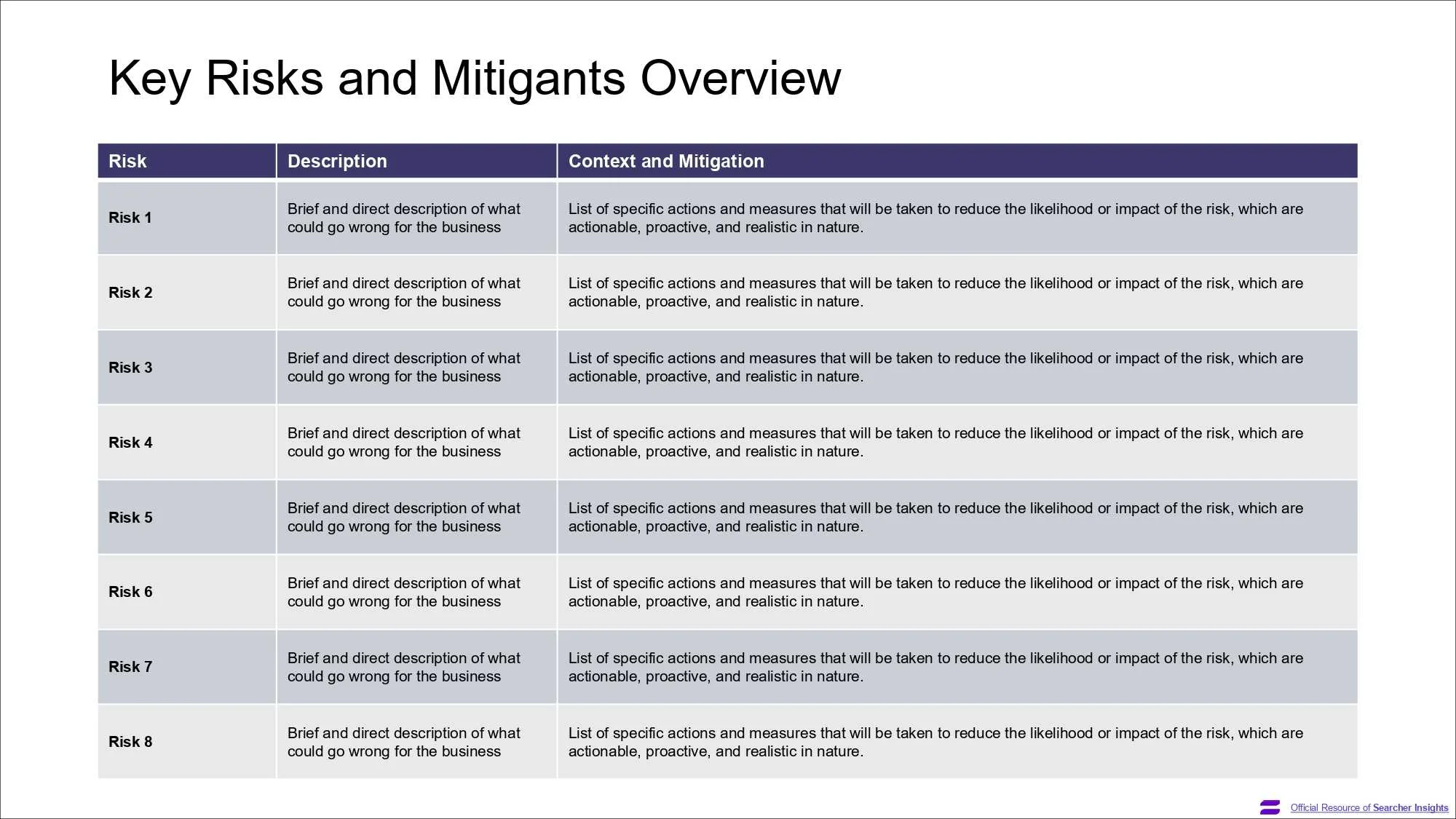

- Include Risk Factors and Mitigants: Briefly outline key risks that could impact the business and your financial projections, along with the specific actions and measures you’ll take to mitigate them.

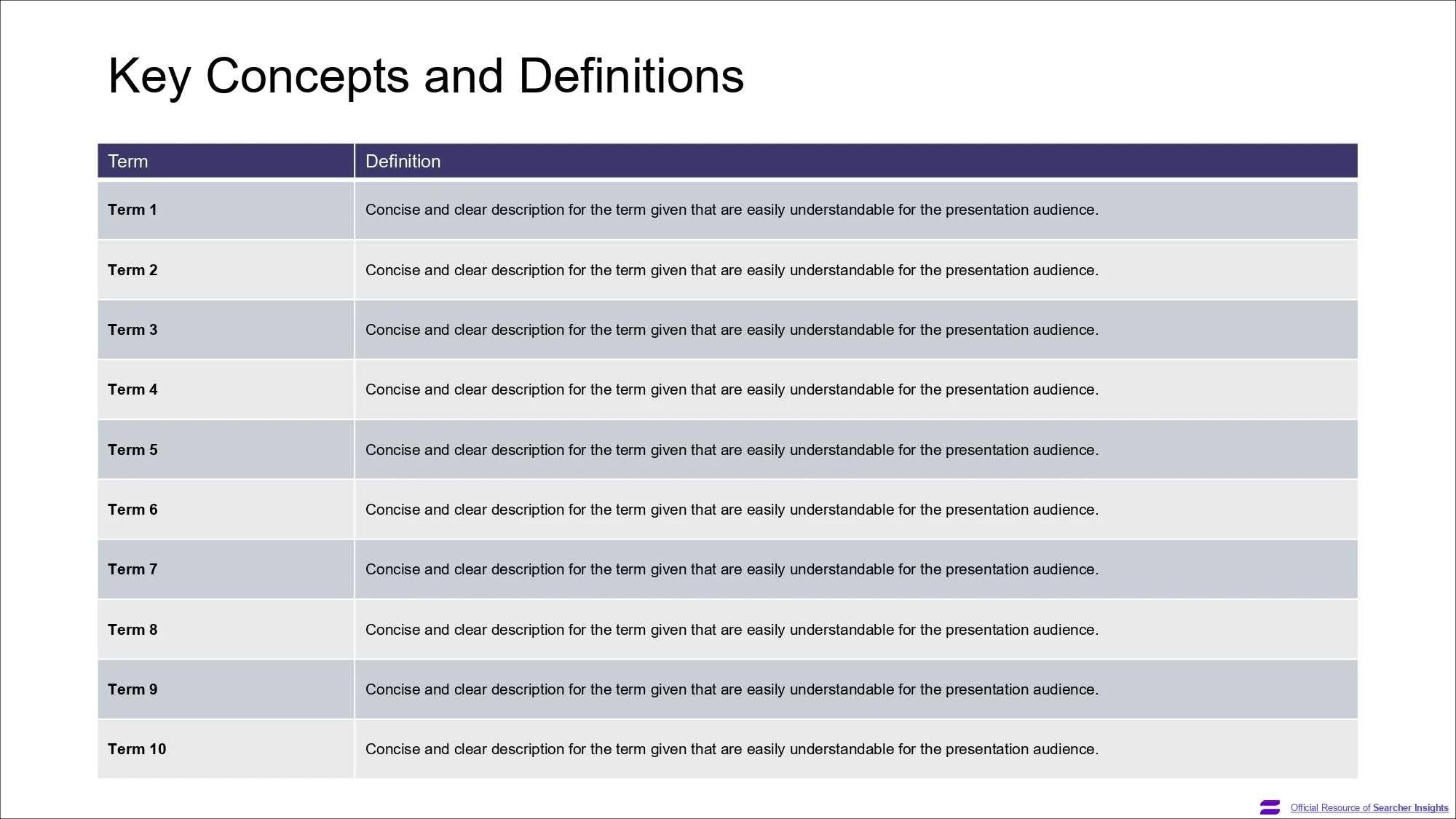

- Define Key Terms (Optional but helpful): If your presentation uses industry-specific or financial terms that might not be universally understood, consider a slide defining them clearly.

The Financial Analysis section should provide a transparent and well-supported view of the company’s financial past and its potential future, giving investors confidence in your ability to manage the business profitably and achieve the projected returns.

Having presented a comprehensive overview of the company, the industry, your strategic plans, the deal, and the financial outlook, you’re ready to summarize your case and call for the next step.

Create Your Perfect Pitch with our Template

Crafting a compelling search fund pitch deck is a multi-faceted endeavor that requires a deep understanding of your target company, the market it operates in, and the key drivers of value creation.

Try our Complete and Comprehensive Search Pitch Deck template – available and visible ONLY for our registered members – below.

If the Download button is not visible, register first as a member of the Searcher Insights.

What are your thoughts on this definitive guide to search fund pitch decks? Is there anything you feel is missing or could be expanded upon?

Contact us for your feedback, and we’ll make necessary improvements.